Introduction to the principle of price movement

Hello, friends. I would like to bring some live communication to this topic on the forum. DeltaRiver Terminal is actively developing and we understand that there is very little information available in English. We will fix this. I apologize in advance for not very good English, but I think it will be clear.

Let's agree right away that we are discussing the Forex market? The fact is that the Forex market has one important distinguishing feature - it is a decentralized market (there is no single exchange) and it has a very large daily money turnover. Let's compare it to the stock market. Shares of companies (for example, Tesla, Apple) are traded on a limited number of exchanges, we can easily calculate the turnover, liquidity, we can see the order book and know the open interest in these shares. In the Forex market, we are deprived of this: we do not have a single quotation center, there is no direct data on trading volumes. There are futures for currency pairs, for example, the EU futures for the EURUSD currency pair. But if we compare the trading volume of the EU futures and the average daily turnover in the Forex market for the EURUSD pair, then there will be a clear preponderance in favor of the currency pair. Accordingly, it is difficult for us to determine the truth in which instrument is the leading and which is the slave. Moreover, exchange robots based on arbitrage algorithms fully synchronize price movements.

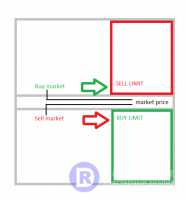

This is why the Delta River Terminal was created. Delta River is a volumetric cluster analysis terminal. It can work with both real exchange data and tick data that is transmitted to us by the Forex broker. Special attention should be paid to the topic of tick data. Delta River processes tick data using special algorithms and converts tick data into so-called synthetic volumes. Synthetic volume is a new concept. We can call the synthetic volume market activity, and this is very valuable information, because it is the market activity (market execution of orders) that drives the price movement. Let's think, what kind of orders exist on exchanges? There are two groups of orders globally on the exchange: market orders and limit orders. Limit orders are orders placed at specific price levels and for a specific volume. Buy Limit and Sell Limit, take profit. As soon as the price reaches these price levels, orders are executed. An important characteristic of these orders is the price. This is the meaning of limit orders - execution strictly at the stated price or price is better. The second group of orders on the exchange are market orders. This group includes directly market orders as orders to “buy” or “sell” now at the market price immediately (the price that is now in the moment), stop loss orders, buy-stop and sell-stop. Stop loss orders, buy-stop and sell-stop are “inactive” orders, they, like limit orders, “wait” for the price to be reached, at which they are set and are activated when the price is reached, but they are executed as market orders.

I propose to analyze the issue of price movement from the point of view of the order book. The order book is an electronic list of buy or sell orders (Buy Limit and Sell Limit). But we are discussing price movements in the Forex market, where there is no relevant and available trading data. I believe that it is necessary to use a simplified model of the order book, with the help of which we can correlate the data that Delta River gives us and the logic of the order book. The symbiosis of the simplified order book model and the display of data in Delta River effectively allows you to understand the reason for the start of the price movement or the reason for the stop of the price movement. Let's see this model

On it, we see the current market price, buy limit orders below the market price and sell limit orders above the market price. These orders are constantly changing at times - the order book is a dynamic structure. In it we see the “game” of market participants. A market deal is always buying and selling at the same time. This is a two-way auction. And we are smoothly getting to the role of market orders. We see limit buy orders, limit sell orders - can they make a deal with each other? No, they cannot make a deal between themselves. The point of a limit order is execution at the requested price or better. We see that the limit buyer's quote is below the market price, and the limit seller's quote is above the market price. They "will not agree" among themselves. This would contradict the concept of limit orders. And this is where we turn to market orders. They play a key role in the order book. I repeat once again: to complete a transaction on the exchange, you need a buyer and a seller at the same time. A market buy order is an order to buy immediately at the current market price. And what are we buying by giving this order? A market participant making a buy order by the market buys a counter order from the limit seller. We have a buyer and we have a seller, the deal went through. A market participant making a sell order at the market sells to an opposite limit buyer. We have a seller and we have a buyer, the deal went through. This is a very simple and logical model that shows a two-way auction on an exchange.

But a large number of buy and sell transactions take place on the market at the same time. We will never be able to track a single trade operation, we must look at the execution of orders from the point of view of arrays of executed orders. By analyzing these arrays of orders, we will be able to determine the alignment of forces in the market with a certain probability. The price moves in the direction in which it is supported by market orders and there is no counter resistance. The price stops at the price level where market orders do not have the required volume to absorb the volume of counter orders.

.....to be continued.

Комментариев 1